What a boring week!

The week ending on 23 August 2013 was a week in which the Fed's officials very clearly went out of their way to not make any noise as they jetted off to Jackson Hole, Wyoming for their annual retreat. And in the absence of other noise or significant changes in the fundamental outlook for the companies that make up most of the U.S. stock market, the market pretty much ended exactly at the same level it ended in the previous week.

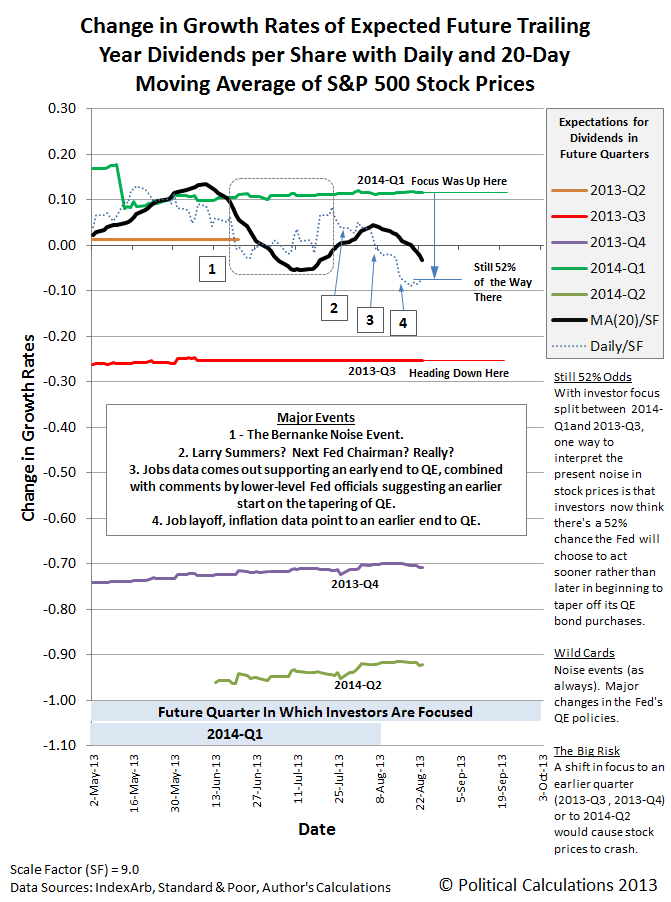

Really! To illustrate the point, we added just two words to our notes on our chart from last week. Actually, just the same word twice "Still":

The biggest market-driving news of the week was the release of the notes from the Fed's 31 July 2013 meeting on Wednesday, 21 August 2013. And because they didn't provide any greater clarity for when the Fed might begin slowing the purchases of U.S. Treasuries and mortgage-backed securities that make up its current quantitative easing scheme, the change in the growth rate of stock prices remained stuck about halfway between the future associated with an earlier slowdown (2013-Q3) and the future associated with a later slowdown (2014-Q1).

It's almost as if the whole last week never happened!

Speaking of the split in the consensus for when the Fed's current QE program will begin to draw down, we wonder if the split in the consensus of the Federal Reserve's Open Market Committee is the same as the split we observe in the expectations for these two potential futures.

There was one item in last week's news that we found noteworthy. It seems an economist from Princeton University has arrived at the same conclusion about the role of the Fed in creating the market turbulence we've seen this summer that we did just a day after the event in question, although it took them over two months to reach that same conclusion and communicate it to Fed officials.

JACKSON HOLE, Wyo.—The Federal Reserve believes that providing clear guidance about the likely future course of its policies make them more effective in boosting the economy, while helping to tamp down on market volatility and uncertainty.

That may not be so, said a paper presented here Saturday by Jean-Pierre Landau of Princeton University at the research conference hosted by the Federal Reserve Bank of Kansas City.

Over the last year, the Fed has been buying $85 billion a month of bonds in an effort to lower long-term interest rates, hoping that will spur growth and lower unemployment. Fed officials have been warning for months since May that they could start scaling back the program if the economy continues to improve as they expect.

The problem for the Fed is that as its policy makers have tried to prepare markets for this shift, they've generated considerable market volatility, in part driving up bond yields and boosting borrowing costs.

But the best part is when the Princeton economist discovers the role of what we've long described as "noise events" in affecting markets:

Mr. Landau lays a lot of the blame for the bond-market turbulence on the Fed itself. The paper notes that current Fed guidance on the policy outlook eliminates the cost of leverage, and creates "strong incentives" to increase and even overextend investment exposures.

In turn, "this makes financial intermediaries very sensitive to 'news,'" whatever that may be, he wrote. In this case, the catalyst for the market tumult is the Fed's statements about possibly scaling back the bond program this year. Once that view was conveyed to markets, it drove a big shift in market positions, to a degree that was very surprising to many observers.

But perhaps not so surprising if you know what expectations for things like stock prices are associated with different points of time in the future. And as we're emphasizing today, for the current "market tumult", it's really just a matter of determining how split investors are between the outlooks that apply for each of those alternative futures.

We'll see how long it takes Princeton's economics department to catch up to that realization. Our guess though is that Princeton's physics department may beat them to it, since this is, after all, the financial equivalent of the many-worlds variant of Schrödinger's Cat experiment....

Previously on Political Calculations

We had looked forward to a boring summer. Instead, we've found ourselves providing the following observations and near real-time analysis of the economic story of the summer, to which the economics department at Princeton University would appear to only just be beginning to catch on....

- The World Investors and the Fed Live In Now - Our snapshot of the market right before the event, in which we note that investor concern about the future of QE was growing and remark that there will be a market reaction in response to the outcome of the Fed's two-day meeting later that week.

- The Bernanke Noise Event - as the Summer of 2013 shall ever be known to investors....

- Now Is It Time to Sell? - according to statistics, a quaint branch of mathematics that only works to describe how stock prices vary with respect to their trend when order is present in the market. The problem with it is that the market goes in and out of order, so it's periodically pretty useless....

- The Fed's Real QE Mistake: Timing - We explain how Bernanke really screwed up.

- Now What Will You Do? - the statistical line is crossed! We look at everything that we see screaming "sell", without actually saying it's time to sell.

- The Fed Attempts to Walk It Back - we anticipate how the Fed will respond to Bernanke's error, and we determine if it will work.

- The GDP Multiplier for QE - Not about investing, at all! Instead, we explain why sustaining QE at current levels is so important to the U.S. economy at present.

- "Never Bet Against the Fed" - we visually illustrate that the Fed's response to repairing the damage from Chairman Bernanke's blunder is working and recap why fears of stock market doom, despite signals to the contrary, were really overblown.

- Bernanke Closes the Gap - we mark the end of the Bernanke Noise Event.

- The Noise of Summers - we note the beginning of a new negative noise event....

- The S&P 500 Hits 1700 A Month Late - Finally, after all that noise!

- The Fed's Minions Shoot Themselves in the Foot - we discuss the role of new data and comments by Fed officials in forcing stock prices off the pace the Fed had previously preferred.

- How the Timing of the Tapering Is Driving Stock Prices - we apply the kind of analysis that we invented to explain why the market would appear to be split between two very different futures.

The Kind of Analysis That We Invented

- How Stock Prices Work - The basic theory for why "Which Future?" is the most important question for investors to answer.

- The Math Behind How Stock Prices Work - Just as advertised. Welcome to chaos!

- Whither Dividend Futures - we tell you exactly where we get our data. Between this and our math (linked above), you can do this kind of cutting edge analysis too....

- Acceleration, Amplification and Shifting Time - the discovery that led to our inventing this kind of analysis, plus links to our earlier discoveries that made it possible....

Tidak ada komentar:

Posting Komentar