Carpe Diem's Mark Perry has been highlighting positive signs of economic recovery and expansion in the U.S. economy, including some indications that some the regions where the U.S. housing market has fallen the most may finally be bottoming out. Here, he points to a Wall Street Journal article that looks at the housing market of Phoenix, Arizona:

As home prices continue to drop in most cities, a nascent real-estate rebound here holds lessons for the rest of the country. This sprawling desert metropolis was one of the hardest hit housing markets during the bust. Phoenix home prices declined 55% from 2006 through the end of 2011, and Arizona's foreclosure rate jumped to No. 3 in the nation in 2009. Hundreds of thousands of homeowners are underwater, meaning they owe more than their homes are worth.

Now real-estate economists across the country are studying an early but surprisingly broad Phoenix turnaround. The sharp drop in home prices has brought new buyers into the market. Unlike other markets where housing recoveries have been snuffed out by big overhangs of homes for sale and foreclosed properties, inventories are lean here.

Phoenix has hit a bottom," says Thomas Lawler, an independent housing economist who was one of the first to warn six years ago that prices in overbuilt metros were poised to fall.

BloodhoundBlog's Greg Swann is a real-life real estate professional in the Phoenix metropolitan area market. Surprisingly, he has a very different perspective on the state of that housing market:

Don't you love reading all that good news about the the Phoenix real estate market's recovery? Guess what? You're being lied to — as always.

This is what's really happening: FannieMae and FreddieMac are holding foreclosed houses off the market, in anticipation of "selling" them to campaign donors.

Meanwhile, the town is being picked clean, with prices being bid up by buyers convinced that houses are going out of style — a story we've heard before, yes?

As an example, my BargainBot search, which is shared with hundreds of investors all over the world, is at less than 5% of it's peak. A search I use to select premium rental homes produces one listing this morning, where it stood at 45 homes in April of 2011.

If Fannie and Freddie "sell" the homes they own to politically-connected "investors," the rental market in Phoenix will be slaughtered.

And if they release the homes they have been hoarding into the MLS, Phoenix will hit a third bottom before the market can finally recover.

You can call the news media idiots or you can call them liars. But any news from any official source about Phoenix real estate is dangerously misleading.

While we know that Greg's typing "it's peak" will specifically annoy Mark on grammatical grounds, if we go past the post into the comments, he provides more observations that would seem to support his claim:

> I know of REO real estate agent/teams who are starving for transactions now, another proof of shadow inventory.

I started to see the demand-side shortage in April of last year, which is why I noted the numbers from then. We can track that Fannie/Freddie withholding starting in July of 2011, a huge drop-off in the number of homes released into the MLS. If you look at what they’ve dribbled out since then, it’s clear they’re cherry-picking.

He also provided the following data to back his observation that both Fannie Mae and Freddie Mac are restricting the supply of housing in the Phoenix market:

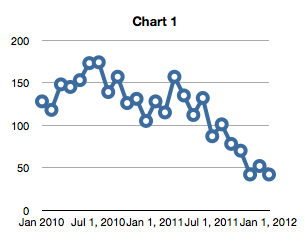

This chart

shows month-by-month releases of lender-owned homes into the MLS from January 2010 to January 2012. This is our Market-Basket search, a subset of the market at large, but that search looks at precisely those bread-and-butter homes that matter most to us: Single-story stucco-and-tile 3-bedroom homes built since 1998. We can’t isolate reliably by owner in an MLS search, but the missing sellers are FannieMae and FreddieMac. They’re hoarding houses, and the artificial shortage they have created is what accounts for the current alleged “recovery.”

But then, another Phoenix area real estate professional, Elizabeth Evans, did her own back-of-the-envelope calculations and found that the apparently restricted supply of lender-owned housing may not be that big of a factor in the Phoenix market:

Fannie and Freddie have around 200,000 properties in their collective inventory. I can’t immediately find how many are in Arizona, so I will make a generous guesstimate. According to a March 1 article on Housing Wire, at the end of 2011 more than 23 percent of the Fannie Mae inventory was in California and the state with the second highest Fannie Mae inventory was Florida at 11.5 percent. There is no way the Arizona inventory could approach that of these two states, but let’s assume a worst case scenario of 8 percent of the GSE inventory situated in Arizona, or 16,000 properties. Some of these properties are located in other parts of Arizona, but let’s assume 75 percent of them, or 12,000 are located in the Greater Phoenix market.

Some of these properties are not fit for occupancy, have residual title issues, or are otherwise unsaleable. Knock off 10 percent as unsaleable, and you are left with 10,800 properties. Not even the most efficient private sector company could do the paperwork amd fix up necessary to get 10,800 properties on the market at once, so let’s give the GSE’s a year to process and list all 10,800 properties in their existing inventory. That’s, ummmm, 900 properties a month.

As of this morning, there are around 9,300 single family homes in Maricopa County and 11,400 in the entire MLS system listed as active. Even if 75 percent of the 900 monthly new listings by the GSE’s, or 675, are single family residences, they aren’t exactly going to dilute the inventory or significantly impact the imbalance of supply and demand.

Last year, Fannie took back around 200,000 homes. I can’t quickly find how many Freddie acquired, but let’s assume these highly efficient agencies could process and sell another 200,000 properties in the same year. That means another 675 single family houses for a total of 1,350 a month that will go on the market. Dilutive? A little, but in an improving economy, I’m pretty sure these properties would be absorbed without a huge impact on price.

If this guesstimate is anywhere near accurate, it proves how unnecessary the bulk sale program is in Arizona. The existing and pipeline inventory could be absorbed with minimum impact on or disruption of the market. This process is called an orderly liquidation. Orderly liquidation realizes the highest price for assets of an entity that must liquidate, exactly what the GSE’s need to accomplish.

The bottom line is that one of these people here on the Internet is wrong. We just don't know which one. The only certainty we have is that Mark Perry will be also be very specifically annoyed by Elizabeth Evans typing of "exactly what the GSE's need to accomplish"....

Image Credit: xkcd

Tidak ada komentar:

Posting Komentar